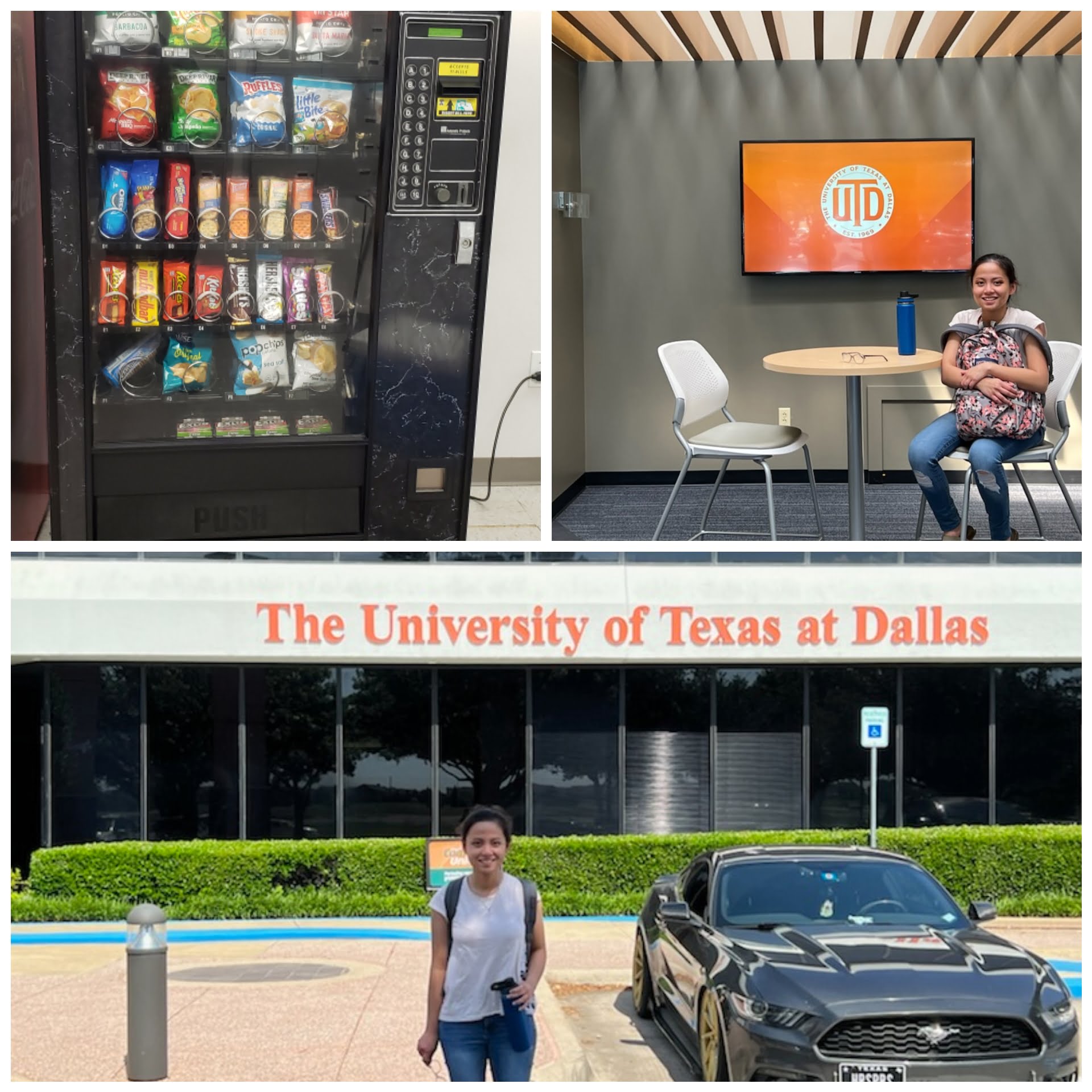

Investments or Expenses, Recover As Fast As Possible

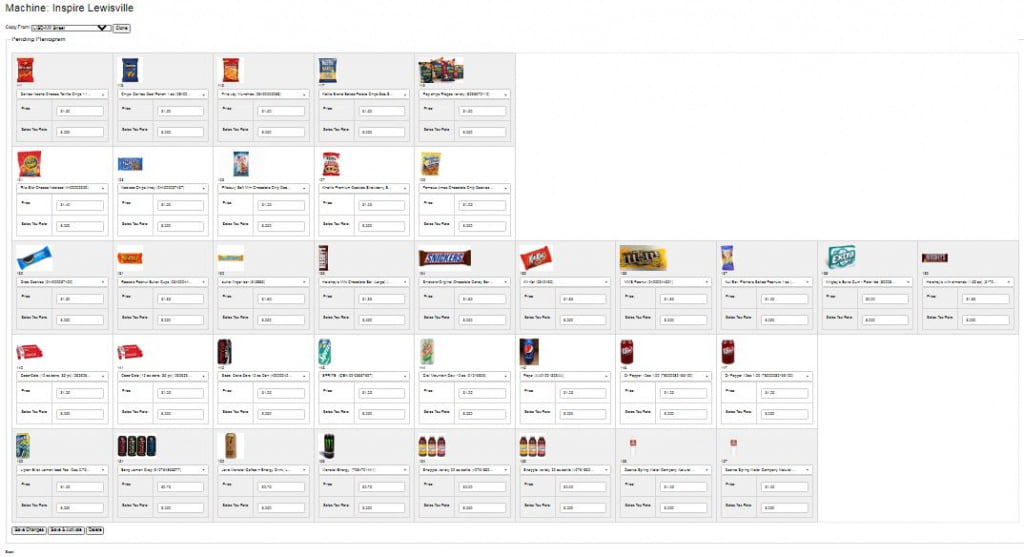

As we already know, continuous investments are imperative in the vending machine business – having a good traffic and location. New locations, maintenance and repairs, and upgrades entail large cash outflows affecting budgets significantly. In the eyes of the accountant, such cash outflows are investments improving the company’s asset ledger. Thus, requiring return on investments or ROI, as fast as possible. In the eyes of the entrepreneur, cash outflows are earmarked expenses fueling the wheel of sales and profit as well.

Noticeably, both agree on shaping-up the company’s financial ledger. Thus, on both points of view – the investment point of view (the accountant’s) and the expense point of view (the entrepreneur’s), agreement on assumptions, method of analysis and sales projections should be established soundly. And, how do we that? Firstly, establishing the numbers using the foot traffic count and secondly, performing location analysis based on the traffic count.

Foot Traffic Count Surveys in the Foot Traffic and Location Analysis

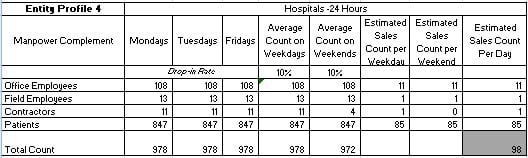

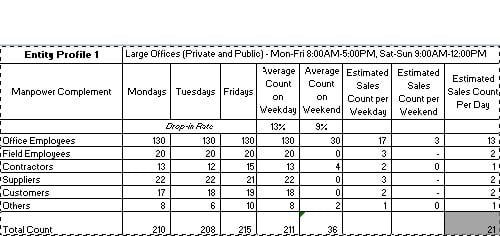

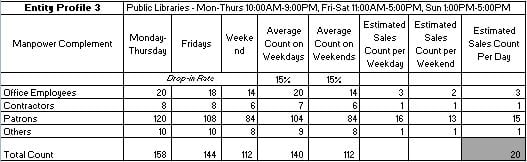

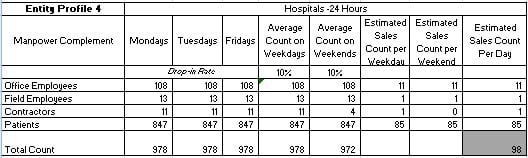

Following are sets of profiled traffic count surveys made in offices, public libraries and hospitals to name a few. Typical counts are also conducted in schools, manufacturing plants and senior living facilities:

Prospective Customer Classification

Normally, the manpower complement is basically divided into two classifications, the internal customers and the external customers. The internal customers are generally office employees and customers in offices and public libraries, and patients/patrons categorized in hospitals and senior living facilities, and are categorized as prospective customers who stays inside the office. The external customers are field employees, contractors and suppliers, and are categorized as prospective customers who come and go in the office.

Computing the Foot Traffic Count

After tabulating the actual foot traffic counts for each manpower complement over the days intervals, say Mondays, Wednesdays and weekends, you will have to average the counts of the chosen days intervals for each manpower complement in preparation of applying the established drop-in rate. After applying the drop-in rate, the estimated sales over the weekdays and weekends are obtained.

Finally, the total count of the foot traffic count is achieved by summing up the estimated sales count per day column. And, that is the number you’ll decide whether a placement of a vending machine in the location under study is a go or no go!

Looks simple enough, right?

Establishing the Drop-in Rate in the Foot Traffic and Location Analysis

It is worth mentioning the drop-in rate in this article however it is lengthy in scope and requires deeper analysis to appreciate its value in foot traffic and location analysis. Drop-in rate analysis requires insights on the location where the vending machine(s) will be placed and experience in vending machine sales and operations. As prologue to this topic, it should not be isolated foot traffic and location analysis at any rate. It is just a topic worth being its own article.

In Essence…

Gone are the days assuming certain locations is a go without making a study. If so, investment figures and payback periods will suffers. And, thus definitely, hurting your ROI. At this point, it is imperative, the lack of sound assumptions, method of analysis and sales projections will hurt the entrepreneur deeply.

We have similar and helpful topics on traffic analysis, drop-in evaluation and profit and loss based on the outcomes at DEAJ Oil and Gas Downstream Marketing Retail website at http://deajoilgas.com. Enjoy reading!